vermont income tax rate 2020

Vermonts Income Tax Vermont has a progressive state income tax. Five tax rates tax income earned in different amounts or bands at higher levels.

Vermont Montpelier Montpelier Vermont Capitol Building

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

. 2019 VT Rate Schedules. In 2019 and 2020 the capital gains tax rates are either 0 15 or 20 for most. Five tax rates tax income earned in different amounts or bands at higher levels.

Corporate and Business Income. Vermonts Income Tax Vermont has a progressive state income tax. 2020 VT Tax Tables.

2020 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Meanwhile total state and local sales taxes range from 6 to 7. PA-1 Special Power of Attorney.

8 8 8 8. The lowest rate starts at 355 then progressively bumps up to 7 825 89 and tops out at 94. W-4VT Employees Withholding Allowance Certificate.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. The lowest rate starts at 355 then progressively bumps up to 7 825 89 and tops out at 94. 18 18 18 18.

Detailed Vermont state income tax rates and brackets are available on this page. 2020 Vermont Tax Deduction Amounts. This column also applies to qualifying widower and civil union filing jointly status This column also applies to civil union filing separately status.

The bill proposes to raise the estate tax exclusion over the course of two years. Tax Rate Class. Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax bracket to 875 the highest Vermont.

PR-141 HI-144 2020 Instructions 2020 Renter Rebate Claim. A financial advisor in Vermont can help you understand how taxes fit into your overall financial goals. No Vermont cities have local income taxes.

5 5 5 5. Find your pretax deductions including 401K flexible account contributions. Monday February 8 2021 - 1200.

Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid. Tax Year 2020 Personal Income Tax - VT Rate Schedules. Tax Tables 2020 2020 Vermont Tax Tables.

2020 VT Tax Tables. 2021 Income Tax Withholding Instructions Tables and Charts. Taxable wages are the first 16100 effective 010120 to 12312020 paid to each 20 employee in a calendar year.

Vermont has a progressive state income tax system with four brackets. Five tax rates tax income earned in different amounts or bands at higher levels. Currently the estate tax is 16 on the value of any estate over the exclusion amount of 275 million.

2020 VT Rate Schedules. 12 12 12 12. Higher rates kick in when a taxpayers income reaches a set amount.

Vermont School District Codes. IN-111 Vermont Income Tax Return. We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes.

How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

Pay Estimated Income Tax by Voucher. For the 2020 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. Find your income exemptions.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875. Beside above what.

Marginal tax rate 22 Effective tax rate 1198 Federal income tax 8387 State taxes Marginal tax rate 760 Effective tax rate 645 Vermont state. Vermonts Income Tax Vermont has a progressive state income tax. Tax Rate Filing Status Income Range Taxes Due 335 Single 0 to 40350 335 of Income MFS 0 to 33725.

TaxTables-2020pdf 27684 KB File Format. 15 15 15 15. RateSched-2020pdf 11722 KB File.

E-File Your Tax Filing for Free. Vermonts tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. The plan would provide 350.

LC-142 2020 Instructions 2020 File your Landlord Certificate Form LC-142 online using myVTax or review the online filing instructions. IN-111 Vermont Income Tax Return. The lowest rate starts at 355 then progressively bumps up to 7 825 89 and tops out at 94.

Second if you were determined to be a successor to another business and eligible for a transfer of their experience rate your rate notice will include any. Higher rates kick in when a taxpayers income reaches a set amount. THE TAX SCHEDULES AND RATES ARE AS FOLLOWS.

Find your gross income. W-4VT Employees Withholding Allowance Certificate. Then your VT Tax is.

0 0 0 0. 2020 Vermont Tax Tables. The First Tier includes single tax filers with incomes up to 75000 and joint filers with incomes up to 150000.

Pay Estimated Income Tax Online. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. Vermont Tax Brackets for Tax Year 2020 As you can see your Vermont income is taxed at different rates within the given tax brackets.

Beginning January 1 2020 the estate tax exclusion. Check the 2020 Vermont state tax rate and the rules to calculate state income tax. The states top income tax rate of 875 is one of the highest in the nation.

PA-1 Special Power of Attorney.

Vermont Income Tax Calculator Smartasset

All But 2 Vermont Counties Have High Covid Levels Cdc Says Vtdigger

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Personal Income Tax Department Of Taxes

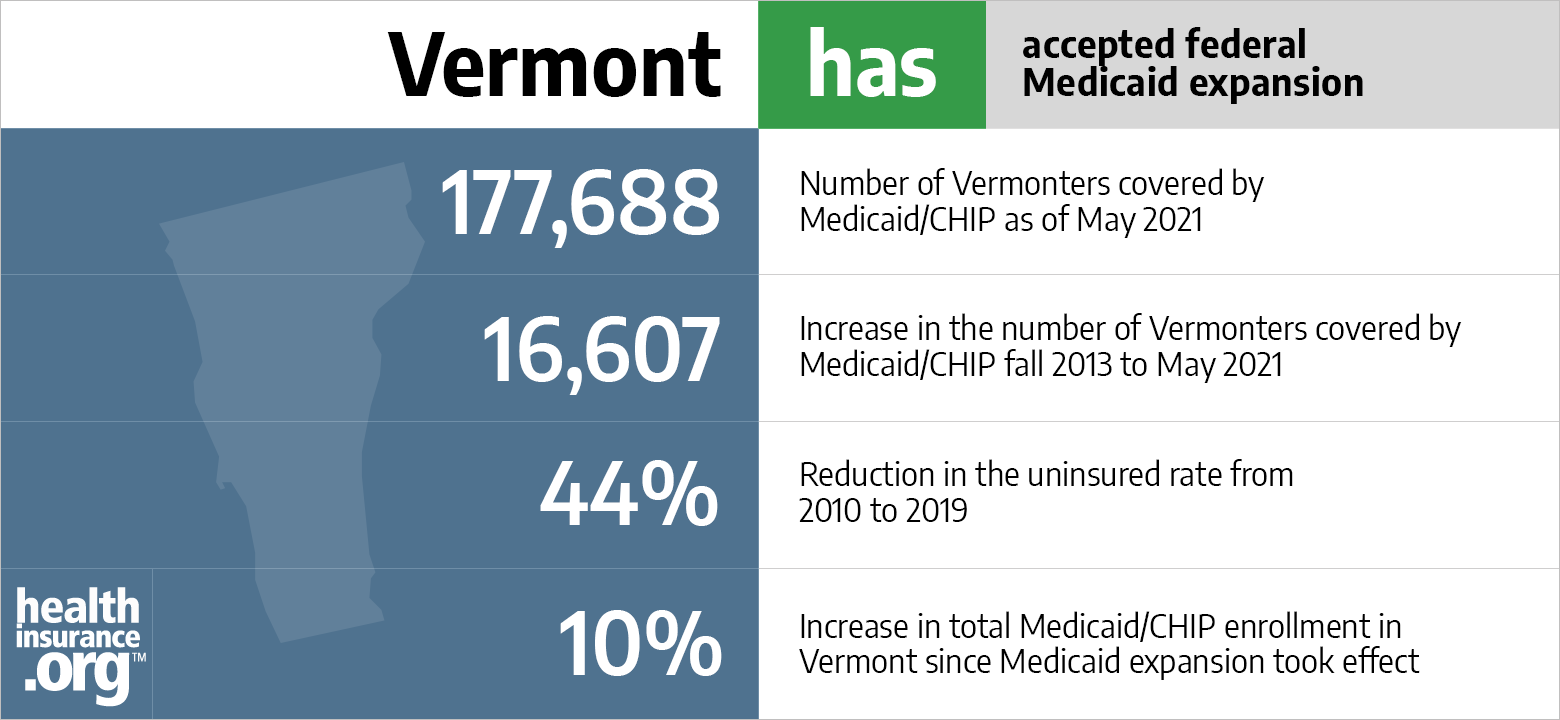

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Paycheck Calculator Smartasset

Vermont Will Stop Updating Its Covid Case Dashboard Next Week Vtdigger

Vermont Income Tax Brackets 2020

Vermont Income Tax Calculator Smartasset

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design